ELEMENT 1: ENTRY STAGE EVOLUTIONS:

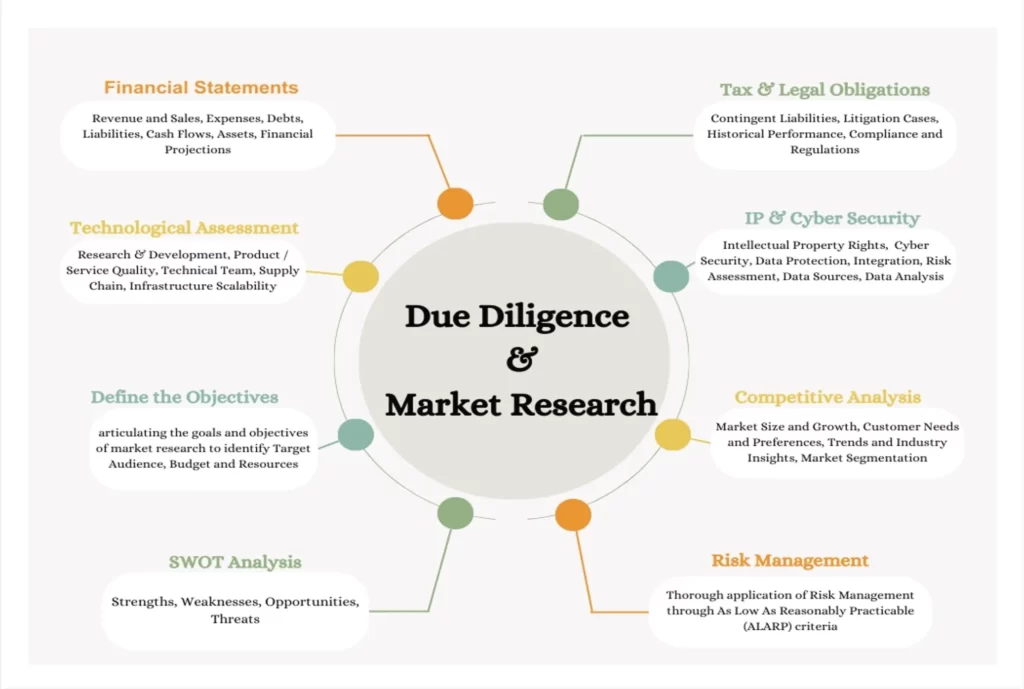

DUE DILIGENCE:

BELA, through a proper and detailed analysis of the market research, addresses the issues relating to Economic as well as Legal affairs that foremost covers the aspect of Due Diligence. By taking into consideration financial histories, company status, profit margins, and other crucial aspects, it ensures trustworthiness and reliability amongst the Joint Ventures, Collaborators, and Technology Transfer Partners on the foreign land.

BELA curate its services for each distinct business and assesses their requirements accordingly. Hence, providing a comprehensive report, outlining the optimal and the finest strategy for a successful business establishment.

The detailed report shall include:

- Compliance: Ensuring adherence to applicable laws and regulations.

- Regulatory Insights: Identifying violations or disciplinary actions.

- Financial Analysis: Assessing financial statements, profit margins, and assets.

- Assets Evaluation: Evaluating real assets, Intellectual Property, Brand Values, and more.

- Taxation Assessment: Checking for unpaid taxes and liens.

- Intangible Assets: Reputation, Goodwill and other intangible Assets.

- Cross-Border Considerations: Addressing challenges such as Double taxation, Foreign Exchange fluctuations, Sovereign risk, and Cultural Aspects.

TYPES OF DUE DILIGENCE: BELA bifurcates the concept of due diligence into three categories, each serving a crucial role in evaluating your potential business ventures:

- BUSINESS DUE DILIGENCE: The business due diligence explicitly includes:

- Operational Due Diligence: It focuses on assessing the operational aspects of the target company, including technology upgrades, process improvements, and financial impacts and aims to uncover the weaknesses and control deficiencies, as could be.

- Strategic Due Diligence: It evaluates the strategic aspects of a proposed business initiative, considering value creation, competitive positioning, and commercial viability of your venture in the foreign markets, ensuring informed decision-making.

- Technical Due Diligence: It encompasses Intellectual Property (IP) due diligence which evaluates the value and legitimacy of IP assets, and Technology due diligence, which assesses IT infrastructure and future technology needs.

- Environmental Due Diligence: It analyses environmental risks and liabilities associated with a target organization, including historical context, site conditions, operations, and legal compliance.

- Human Resource Due Diligence: It focuses on issues of individuals, such as personnel’s motivation and positive working environment, to ensure a smooth transition and maintain operating synergies.

- Information Security Due Diligence: It evaluates information security and digital confidentiality risks during IT procurement to uncover potential cyber-security vulnerabilities of your business operations.

- Ethical Due Diligence: It measures the ethical character of a company and identifies risks related to its’ reputation, governance, and helps the organization in assessing ethical viability of their prospective collaborators.

- LEGAL DUE DILIGENCE:

BELA takes immense pride in its dedicated team of legal experts who excel in navigating the international trade. Their expertise extends across a wide spectrum, covering liabilities, regulatory compliance, and the meticulous identification of potential legal challenges.

The realm of Legal Due Diligence includes:

- Exhaustive Regulatory Checklists

- Direct And Insightful Interactions with Key Personnel

- Document Verification

- Review of Licensing and other Compliance Prerequisites

- Global Dispute Resolution Techniques

- And other critical facets.

With BELA by side, one can be assured of a positive and seamless experience in international trade, as our team's expertise ensures that all legal aspects are addressed properly, facilitating smooth and compliant international business transactions.

- FINANCIAL DUE DILIGENCE: BELA offers a comprehensive suite of Financial Due Diligence services. Within this domain it shall conduct an exhaustive analysis that encompasses the financial, commercial, operational, and strategical assumptions relating to business transactions within the target country.

The scope of Financial Due Diligence includes:

- examination of accounting policies, internal audit procedures,

- the sustainability of earnings and cash flow,

- the condition and valuation of assets,

- the identification of potential liabilities,

- the implications of taxation,

- the reliability of information systems,

- and the effectiveness of internal control systems.

Each facet of this assessment is tailored to align seamlessly with the specific needs and preferences of our valued client businesses. BELA’s tax due diligence services delve into tax planning and compliances, identification of potential contingencies, transfer pricing.

BELA is an exhaustive due diligence service provider offering high quality assessments which allow businesses to gain invaluable insights into potential investments, and ensures that every facet is thoroughly scrutinized, leading to an informed decision-making.

RISK ANALYSIS SERVICES:

Establishment of a business in a foreign country requires a thorough assessment of associated business risks. BELA specializes in addressing these risks and tailors its analysis to align with the specific needs of the client’s business, dynamics of the foreign market, and the demands of the product landscape.

The types of risk assessments are detailed in the following sections:

Types of Risk Assessments by BELA:

- Economic Risk in International Trade: Evaluating economic data from countries, considering indicators such as banking sector stability, GDP projections, debt-to-GDP ratio, unemployment rates, and currency stability to assess economic risks.

- Political Risk: Assessing factors like government stability, transparency, terrorism threats, regulatory landscapes, workforce freedom, government support, immigration laws, and attitudes towards foreign investment.

- Structural Assessment: Examining demographics, physical and social infrastructure, labour force availability, competitive landscape, treaties, export/import regulations, and co-production opportunities.

- Debt Management: Monitoring indicators like total debt-to-GNP ratio, debt service to exports ratio, and current account balance to GNP ratio helps us understand the impact of government debt on business.

- Country Risk Ratings: Assessing risk ratings based on various factors to gauge the level of risk associated with doing business in a specific country.

- Importance of Mitigating Country Risk: Emphasizing the consequences of neglecting country risk, including potential losses, business failures, legal issues, and damage to reputation.

FIVE-STAGE RISK ASSESSMENT PROCESS: BELA undergoes a five-stage risk assessment process as per the unique needs of each business. These stages include:

STEP 1: Mapping Cargo Flow and Identifying Partners: Interpreting all the parties to the supply chain and goods transportation components.

STEP 2: Conducting a Threat Assessment: Assessing risks associated with the supply chain considering country specific illegal acts.

STEP 3: Conducting a Vulnerability Assessment: Examining processes of supply chain, compliance with C-TPAT (Customs-Trade Partnership against Terrorism) criteria and assessing vulnerabilities.

STEP 4: Preparing an Action Plan: Curating a detailed plan to address Strength, Weaknesses, Opportunities and Threats (SWOT).

STEP 5: Risk Assessment Process: Documenting the Risk Assessment Process wherein all the relevant Control, Inherent Risks associated with the business are managed.